Clark Wealth Partners Can Be Fun For Anyone

The smart Trick of Clark Wealth Partners That Nobody is Discussing

Table of ContentsClark Wealth Partners - QuestionsThe Single Strategy To Use For Clark Wealth PartnersThe Ultimate Guide To Clark Wealth PartnersClark Wealth Partners Fundamentals ExplainedFascination About Clark Wealth PartnersExcitement About Clark Wealth PartnersThe 9-Minute Rule for Clark Wealth Partners

The globe of money is a complex one. The FINRA Structure's National Capability Research Study, as an example, just recently located that nearly two-thirds of Americans were incapable to pass a basic, five-question financial literacy examination that quizzed individuals on topics such as interest, debt, and other reasonably fundamental concepts. It's little marvel, after that, that we often see headlines lamenting the bad state of a lot of Americans' financial resources (financial planner scott afb il).Along with managing their existing clients, economic experts will certainly frequently invest a reasonable amount of time each week conference with possible customers and marketing their services to maintain and expand their business. For those thinking about coming to be a monetary advisor, it is crucial to consider the ordinary salary and job security for those working in the area.

Courses in tax obligations, estate planning, financial investments, and threat monitoring can be valuable for students on this course also. Depending upon your one-of-a-kind occupation goals, you might additionally require to make details licenses to fulfill certain customers' needs, such as buying and offering stocks, bonds, and insurance plan. It can also be handy to earn an accreditation such as a Licensed Financial Planner (CFP), Chartered Financial Expert (CFA), or Personal Financial Professional (PFS).

The Clark Wealth Partners PDFs

Many people make a decision to obtain aid by utilizing the services of a monetary expert. What that looks like can be a variety of points, and can vary relying on your age and phase of life. Prior to you do anything, research is key. Some individuals worry that they need a specific quantity of cash to invest before they can obtain help from a specialist.

Not known Incorrect Statements About Clark Wealth Partners

If you haven't had any kind of experience with a financial advisor, right here's what to anticipate: They'll begin by giving a comprehensive assessment of where you stand with your assets, responsibilities and whether you're satisfying standards compared to your peers for savings and retirement. They'll assess brief- and lasting objectives. What's practical about this action is that it is customized for you.

You're young and working complete time, have an auto or 2 and there are pupil financings to settle. Right here are some feasible ideas to help: Establish great cost savings routines, pay off financial debt, established baseline goals. Pay off trainee financings. Depending on your occupation, you may qualify to have component of your school car loan forgoed.

Clark Wealth Partners for Dummies

After that you can talk about the next ideal time for follow-up. Before you start, inquire about pricing. Financial consultants usually have different rates of rates. Some have minimal asset degrees and will bill a cost commonly a number of thousand bucks for developing and adjusting a plan, or they might bill a flat charge.

You're looking in advance to your retired life and assisting your kids with greater education and learning expenses. An economic consultant can use suggestions for those situations and more.

The 15-Second Trick For Clark Wealth Partners

Set up routine check-ins with your coordinator to fine-tune your plan as needed. Stabilizing financial savings for retired life and college expenses for your children can be challenging.

Thinking of when you can retire and what post-retirement years could appear like can produce worries about whether your retirement financial savings are in line with your post-work strategies, or if you have actually saved enough to leave a tradition. Assist your monetary specialist recognize your approach to money. If you are a lot more traditional with saving (and possible loss), their pointers ought to reply to your fears and issues.

Examine This Report about Clark Wealth Partners

Intending for health treatment is one of the big unknowns in retirement, and a financial professional can outline options and suggest whether added insurance as security might be valuable. Prior to you start, attempt to get comfortable with the idea of sharing your entire financial photo with a professional.

Providing your professional a full picture can aid them develop a plan that's prioritized to all components of your monetary status, especially as you're fast approaching your post-work years. If your funds are basic and you have a love for doing it on click for more info your own, you may be fine by yourself.

A financial expert is not only for the super-rich; any person facing major life changes, nearing retired life, or feeling overwhelmed by economic choices can take advantage of expert assistance. This write-up discovers the duty of financial consultants, when you may need to consult one, and essential considerations for choosing - https://clrkwlthprtnr.creator-spring.com. A financial consultant is a skilled expert that assists customers manage their funds and make informed choices that align with their life goals

Clark Wealth Partners - Truths

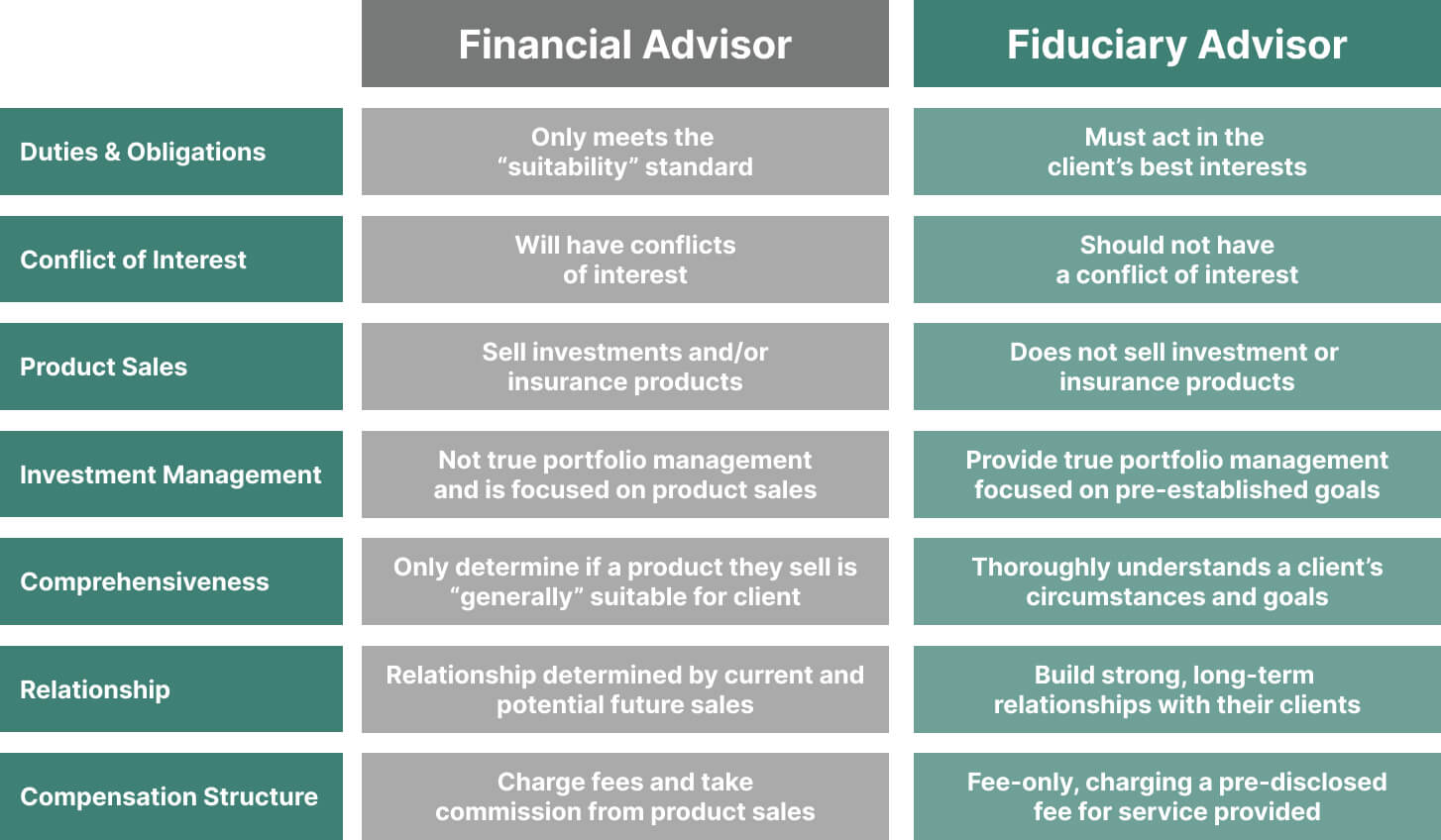

Compensation models also vary. Fee-only experts charge a flat charge, per hour rate, or a percent of assets under monitoring, which tends to lower possible problems of passion. In contrast, commission-based consultants make income through the monetary items they offer, which may affect their recommendations. Whether it is marriage, separation, the birth of a child, job changes, or the loss of a liked one, these occasions have distinct monetary effects, commonly calling for prompt decisions that can have long-term effects.